Annuity Principal Calculation

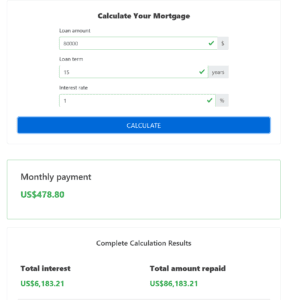

The calculation of the principal for the annuity payout is used if we need to find out how much capital (principal) we need to save (or obtain in some other manner) to be able to pay the annuity in the required amount and frequency through the requested period. Let’s say we want to improve our pension, and the goal is to achieve a monthly annuity payout of $1,000 through the first 20 years. By calculating the principal for the annuity payout, we will find out what amount we need to save to be able to pay the required annuity. The annuity payout calculator (above) offers such a calculation.

A Sequence of Annual Returns Is Important (if We Simultaneously Pay Out the Annuity)

The calculation of the annuity payout principal has only an informative purpose. The reason, as with any other calculation where we work simultaneously with the yield and with the deposit/withdrawal from the principal, is the yield uncertainty and irregularity. If our principal is invested in a certain mix of index equity funds and government bonds where we expect an average annual return of 4%, and at the same time we pay a monthly annuity from it, we simplify the reality to make the calculation, and reasoning about the problem, easier. In real life, however, there will be no such situation in which an investment mix achieves an annual return of 4% for 20 consecutive years.

Yields on stock markets fluctuate. One year they can gain 20%, another 13% and the next one lose 10%. For a completely accurate calculation, we would need to know the yield/loss for each year as well as their exact sequence. The exact sequence is important because it affects the final result. If we start paying an annuity and the markets fall by 10% and 15% in the first two years, our principal will decrease rapidly, and with it, the amount of the monthly annuity that we can pay will also decrease. If, on the other hand, we encounter a good ten years and only score a loss in the 11th and 12th years, it will not affect us almost at all. Let’s show it on a simple example.

The principal is $10,000. At the end of each year, we pay out an annuity of $1,000. During the first four years, we will achieve the following yields/losses: +15%, +8%, +5%, -15%. Let’s show two calculations with a different order of these yields:

From best to the worst year

1st year:

![]()

2nd year:

![]()

3rd year:

![]()

4th year:

![]()

From worst to the best:

1st year:

![]()

2nd year:

![]()

3rd year:

![]()

4th year:

![]()

As you can see, four years with the same yields in a different order and the resulting difference in the balance at the end of the 4th year is $1,000, which corresponds to 10% of the initial principal.

If we had our principal invested in products with a guaranteed fixed yield, such as government bonds, or in products with small fluctuations in performance (such as real estate or investment products focused on real estate – REIT), then our calculation would be very close to the reality. The accuracy would be better.

On the Contrary, if We Will Not Simultaneously Pay Out the Annuity, the Sequence of Annual Returns Does Not Play a Role

If we didn’t pay out a monthly annuity while still saving, the sequence of annual returns wouldn’t play a role. We know from mathematics that.

![]()

and therefore

![]()

Thus, if we invest $10,000 and achieve three years with returns of 10%, 13%, 15%, and one with a loss of 20% and at the same time we do not touch the principal (we do not pay or deposit new funds), it does not matter in what sequence these years occur.

The information in this article is for information purposes only. We are not responsible for the accuracy, reliability or completeness of the information or opinions contained on this website. You can find more information in our Legal Disclaimer.