Calculate Your Mortgage

Understanding Mortgage Strategy: How Loan Term Affects Your Long-Term Financial Outlook

For most people, purchasing real estate is the largest financial commitment of their lives. And with that comes the mortgage — a long-term loan that deserves careful consideration. Whether you’re buying your first flat, upgrading to a family home, or investing in a property, understanding how mortgage financing works is crucial to making informed decisions.

Before you sign any contract, it’s wise to learn about the property acquisition process — from regulatory considerations (like land registry and building authority approvals) to financing structure. One of the best tools to support your decision-making process is a mortgage calculator, which you can find at the top of this page. It allows you to test various borrowing scenarios and answers common questions like:

- What will my monthly mortgage payment be?

- How much interest will I pay in total?

- What’s the complete mortgage repayment breakdown?

More importantly, it helps you compare the total interest paid over time and evaluate your options clearly. Just enter your numbers, and you’ll get a detailed snapshot — including monthly principal and interest payments, a full amortization table, and total loan cost.

What Exactly is a Mortgage?

A mortgage, or mortgage loan, is a secured loan where the property itself acts as collateral. Because the lender holds a lien on the property, they are protected in case of default — allowing them to offer relatively low interest rates compared to unsecured loans. The long repayment period, often 15 to 30 years, makes the mortgage one of the most affordable ways to borrow large sums of money.

Loan Term Matters: Short vs. Long-Term Mortgages

The length of your mortgage term plays a significant role in how much you’ll ultimately pay. A longer term means lower monthly payments, which can make home ownership more accessible — particularly for younger buyers early in their careers. However, the total interest paid is significantly higher compared to a shorter-term mortgage.

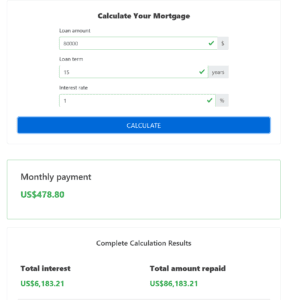

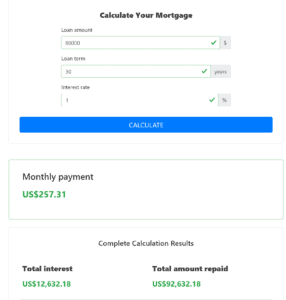

Let’s compare:

- €80,000 mortgage at 1% interest

- 30-year term: monthly payment ~€257.31, total interest paid ~€12,632

- 15-year term: monthly payment ~€478.80, total interest paid ~€6,183

That’s a difference of more than 50% in total interest costs — even though the monthly instalments are nearly double with the shorter term. This illustrates the trade-off between affordability and overall cost.

Factors to Consider When Choosing Your Mortgage Term

Monthly Budget & Financial Flexibility

Before committing to a repayment schedule, assess how much disposable income you’ll have after covering your mortgage and related costs (insurance, maintenance, etc.). Don’t max out your budget — always leave room for unexpected expenses or interest rate hikes once your fixed rate expires.

Interest Rate vs. Investment Returns

If your mortgage rate is lower than the return from a secure investment (e.g. high-yield savings accounts, bonds, or government-backed products), it might make sense to choose a longer repayment period and invest the difference. But this only applies if the investment is low-risk and offers guaranteed returns — otherwise, the strategy introduces avoidable risk.

For example, in some countries (like Norway in 2020), mortgage rates were around 1.4 – 1.8%, while state-subsidized savings accounts offered up to 3.8% return with tax benefits. In such cases, taking a longer mortgage and investing the difference could be a financially sound approach — a financial strategy known as interest rate arbitrage.

Taxation and Fees

Always factor in tax on investment returns, mortgage-related fees, and account maintenance costs when calculating net gains. A lower interest rate doesn’t guarantee a better deal if you’re paying high fees elsewhere. Make sure to compare net returns — not just gross interest rates.

Should You Invest Instead of Repaying Your Mortgage Early?

This brings us to a more advanced concept: opportunity cost. If you’re financially secure and can tolerate some risk, you might consider allocating excess funds to investment vehicles like index funds or diversified portfolios rather than aggressively paying down your mortgage.

But tread carefully. Market-based investments are volatile, and unless you’re confident in managing risk and can lock in your capital for a number of years, this strategy isn’t advisable for the average homeowner. If you’d like a deeper dive into this topic, feel free to request it — or drop a comment below.

Final Thoughts

There’s no one-size-fits-all mortgage strategy. Your decision should balance monthly affordability, long-term interest costs, and your broader financial goals. Whether you opt for faster repayment or strategic investment, always run the numbers — and use reliable tools like our mortgage calculator to support your choices.

The information in this article is for information purposes only. We are not responsible for the accuracy, reliability or completeness of the information or opinions contained on this website. You can find more information in our Legal Disclaimer.